How To Apply For A College Loan

The process of applying for a personal loan may feel overwhelming if you don't know where to begin or the documents you need.

Below are five steps and common questions to help you through the process of applying for and choosing the best personal loan for your financial situation.

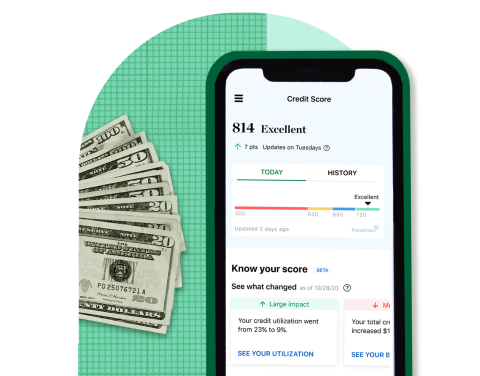

Step 1: Check your credit

Start the process by checking your credit. The rate and loan amount you receive depend a lot on your credit, so checking your credit report lets you spot and fix any errors — like a falsely reported late payment — and strengthen your score before applying for a personal loan.

How does my credit score impact personal loan offers?

Good- or excellent-credit borrowers (those with FICO scores of 690 or above) typically receive lower rates and have a wider group of lenders to choose from. On the other hand, bad- and fair-credit borrowers (FICO scores of 300 to 689) may have fewer options and receive rates at the high end of lenders' ranges.

How do I see my credit score for free?

You can get a free credit score and report with NerdWallet. You can also request free credit reports directly from the three major credit bureaus by using AnnualCreditReport.com .

Step 2: Pre-qualify and compare offers

Pre-qualifying for a personal loan gives you a preview of estimated rates, monthly payments and terms before you submit your application. Most online lenders and some banks let you pre-qualify on a desktop or mobile device.

Will pre-qualifying affect my credit score?

No, pre-qualifying for a personal loan includes a soft inquiry, which doesn't affect your credit score.

Be ready for any loan application

NerdWallet tracks your credit score and shows you ways to build it — for free.

What do I need to pre-qualify for a personal loan?

To pre-qualify, you'll need to provide information such as:

-

Requested loan amount. Lenders typically offer personal loans from $1,000 to $50,000.

-

Preferred monthly payment. Personal loans usually have monthly payments spread over two- to seven-year terms.

-

Personal and financial information. This could include your name, email address, date of birth, address, income, Social Security number and education.

How long will it take to pre-qualify?

Pre-qualifying can take a few seconds or minutes after you submit your information. If you qualify for a loan offer, a new page will appear showing your potential rates and terms.

You may also receive an email from the lender with contact information for customer service and a list of the next steps to help you complete the application.

Step 3: Choose your lender and loan

With offers from multiple lenders, compare your options and choose a lender to move forward with.

How do I choose the best personal loan?

One of the most important factors is the annual percentage rate . It is the total cost of borrowing and includes your interest rate and all additional fees.

The lower the APR, the lower the cost of the loan. APR will vary based on factors like your credit score and income.

Make sure you can comfortably afford the monthly payments. Research any features that are important to you, like flexible payment options, help with building your credit or direct payment to creditors if you're consolidating debt.

Step 4: Gather loan documents

Once you've chosen a loan with the rate, term and features that best fit your budget, it's time to complete the application.

What do I need for my loan application?

You'll need to provide some or all of the following:

-

Proof of identity, including a government-issued ID, recent utility bill or lease agreement.

-

Proof of address.

-

Proof of employment status.

-

Education history, including the highest degree you've earned and graduation date.

-

Income details, including bank statements or pay stubs, and proof of additional income like retirement, alimony or child support.

-

Social Security number if it wasn't submitted during pre-qualification.

Step 5: Submit your application and get funded

Carefully read the loan's terms and conditions, and then submit your application.

The loan agreement certifies that all the information you've submitted is correct. It also authorizes the lender to verify your information, such as contacting your employer and pulling your credit reports.

How will my loan application affect my credit score?

Submitting the formal loan application triggers a hard credit inquiry , shaving up to five points off your FICO score and possibly remaining on your credit report for just over two years.

How long will it take for my application to be approved?

If everything checks out, you could get same-day approval. If the lender requests additional documents, approval may take longer.

How long will it take to get funded?

After you are approved and sign the loan agreement, how quickly you receive the money will likely depend on the type of lender you choose. Many online lenders can provide same-day funding, while some banks may have the money to you in five days or sooner.

Once you receive funding, expect your first loan payment to be due within 30 days. If you've opted into automatic bank payments, the funds will be debited from the bank account you provided. Add your monthly payment amount to your budget to stay on top of your debt repayment .

How To Apply For A College Loan

Source: https://www.nerdwallet.com/article/loans/personal-loans/how-to-apply-for-a-loan

Posted by: salzmanhilierest.blogspot.com

0 Response to "How To Apply For A College Loan"

Post a Comment